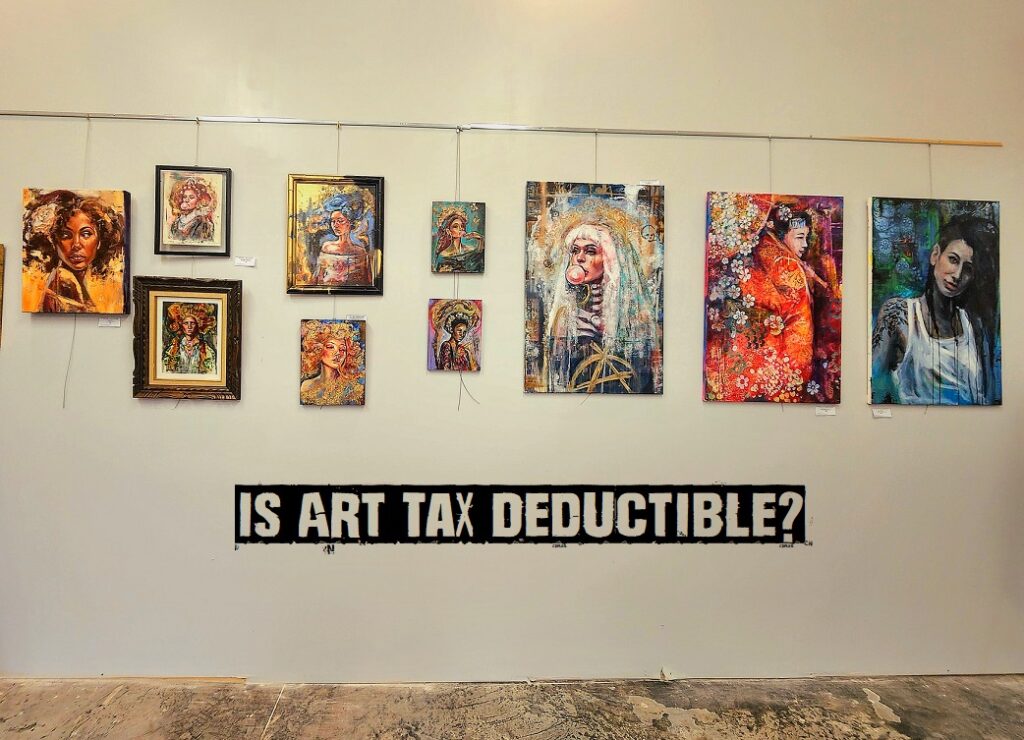

Is That Original Canadian Painting Tax Deductible?

The big question I’ve been getting from my art collectors has been, “Is my Sara Leger original tax deductible?” As a professional artist and business owner my answer is usually, “Maybe?! Check with your tax advisor.” However, I didn’t think that was such a great answer so I did some research on what you need to know about tax rules and benefits around purchasing art in Canada.

Don’t just take the word of galleries, art consultants and artists when it comes to purchasing Canadian art leave that to the tax professionals. They can navigate the intricacies of the Canada Revenue Agency (CRA). Currently my work is hanging in a tax advisors office, you can contact her;)

I’ve don’t a bit of research through the Canada Revenue Agency website and it is possible that your Sara Leger Original was not only a brilliant artistic choice but also a savvy tax deduction. Look at you playing the tax game like a billionaire.

⚠ ATTENTION: I am not a tax expert so please talk to one before the tax man decides to pay you a visit and then you say, “But my artist friend said I would get tax benefits from purchasing her art. “🤦♀️ BAD. BAD, ART COLLECTOR! This is for general understanding and should not be considered advice.

Is Canadian Art Tax Deductible? Yes or No?

YES, Canadian art is deductible if:

- Operating a business (incorporated or unincorporated, freelancers, sole proprietors).

- Art purchased with the intent of long-term display in a business space.

- Intended to benefit the place of business, seen by clients and/or employees.

- Art that is not created by a Canadian a not something that can be a tax deduction. So, why not channel that support to us Canucks? We’re not just polite; we’re also tax-friendly artists. Double win! 🍁🎨

NO, Canadian art is not deductible if:

- Purchased for reasons other than benefiting the business.

- Bought for personal use, as a gift, or for short-term profit through resale.

- Exception: Home is your place of business.

What Type Of Art Qualifies For A Tax Deduction?

- A print, etching, drawing, painting, sculpture, or any visual art where the artist’s hand is evident (that means no Walmart, Home Sense type prints).

- Valued at $200 or more, supported by a verifiable invoice or receipt.

- Created by a Canadian artist or an artist who was Canadian at the time of creating the artwork.

Businesses Eligible

It goes without saying that you have to be a Canadian business and filing taxes with the CRA, whether incorporated or unincorporated, including freelancers and sole proprietorships to benefit. To better define the term business visit the CRA Business Link . But the TYPE of business isn’t the big factor when qualifying for an art write off, the big factor is how you intend to utilize the art purchase and aligning it with your business operation. Consider these possible justifications for classifying an art purchase as a business expense:

- The art is displayed in your place of business, enhancing employee morale, creativity

- The art is on display and communicates the businesses taste, style, etc. to clients.

- The art purchase is directly relevant to business activities, such as a commission of the business or owner.

Now, what won’t fly as a valid tax justification:

- Considering art as profitable inventory for short-term resale.

- Holding onto artwork for an extended period but keeping it out of sight, storage, or at your home where no business activities occur.

Keep it straightforward – if the art genuinely benefits your workplace (backed by numerous studies), justifying it as a business expense shouldn’t be an issue!

Art for Remote Workers

If a large amount of business activities occur at home, in your home office, or elsewhere, you may be eligible to deduct a portion of the artwork’s value as a business expense. To be clear, a few emails or phone calls at home does not count and nor will a painting that you rarely see from your designated office space count.

Here’s where it gets tricky… looking at what I read, yes you can claim art but it’s not as simple as buying a $1000 original piece of art by Sara leger (shameless plug) and then claiming the full amount. You will have to take into consideration the size of the office space, how long you spend in that office space within your home, if you work full time or part time ex 50% then you can only claim 50%. It sounds complicated again TALK TO A TAX EXPERT, not me and certainly don’t go by the singular posts on social media claiming you can.

How Much Of My Art Can I Deduct?

This web page – Classes of Deductible CRA – is a vital resource for Canadian artists, supporting their vision of a thriving art market and empowering their creative and financial journey. It gives crucial insights for Canadian art used in business (not as inventory) and created by a Canadian artist which qualifies as Class 8 depreciable capital property, enabling the claiming of Capital Cost Allowance (CCA). Classes of Deductible CRA

Depreciation and Capital Cost Allowance (CCA): The CRA considers art a depreciable asset, falling under “Class 8.” This means you can claim Capital Cost Allowance (CCA), allowing for a yearly deduction of 20% of its value.

Designated Immediate Expensing Property (DIEP): Introduced by the Canadian Government, DIEP allows a 100% write-off in the year of purchase for designated capital assets, including Class 8 capital assets, from specified dates.

Tax Deduction Rules for Art Rentals: Art rentals aren’t left out – they’re eligible for tax deductions based on the rental cost.

GST Registrants, Listen Up! If you’re on the GST train, you can recover the taxes you paid during the art buy. It’s a little extra perk for keeping things legit.

Buying Canadian art isn’t just a financial move; it’s a statement. It sets you apart, shows local love, and, oh yes, comes with a tax deduction. A win-win-win.

Just The Tax Tips 😉

While I’ve researched and given you the highlights as accurately as I can, it is by no means tax advice. Income tax rules can change and there can be a multitude of exceptions so I encourage you to consult a tax specialist for the specifics on your art purchase. They’re the ones with the calculators and know-how.

Beyond the numbers, buying Canadian art is about supporting our homegrown talents and keeping the artistic heart of our country beating strong. Money can’t buy you happiness but it can buy you the next best thing, that feeling you get from a stunning piece of art that resonates profoundly with who you and your business are.

Thank you for reading and happy art tax savings!